Summary of Vacation Home Ownership Options

- In this post we discuss the traditional and lesser know vacation home options

- Realize that full ownership may provide the highest risk-reward, but this option is not for everyone

- Get introduced to the “Vacation Equity Fund” an innovative why to “invest where you vacation”

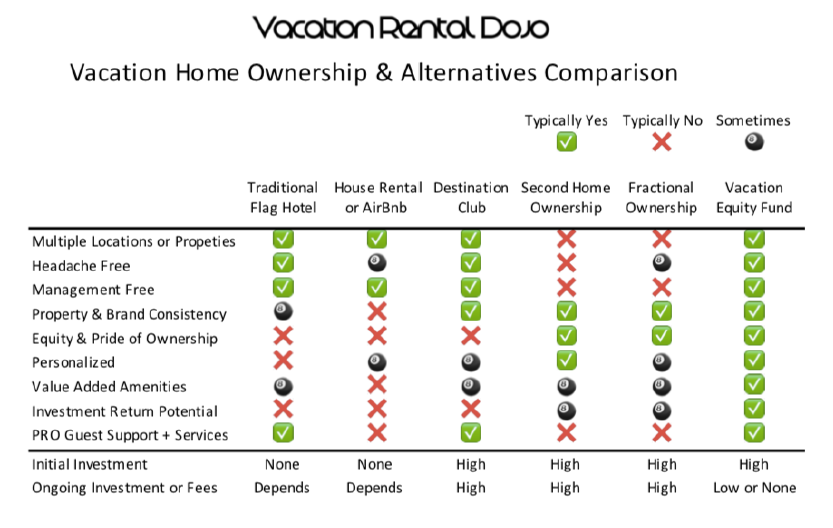

- Side by side vacation home ownership options comparison

Rad News & Opportunities!

- Updated & New Content: Vacation Rental Dojo, Mike & Maria’s Free online vacation rental learning center. PLUS Our Vacation Rental Business Plan in a Box!

- Vacation Rental Confidential, Our Book: VRC is a quick showcase of the Live Swell Story & Proven Biz Model Download Chapters 1 & 2 Free, Our Gift to You

- Exclusive NEW Release: Live Swell’s Sparkling Clean Training & Certification Program

Did you know? There are a surprising number of vacation home ownership options available other than buying a second home outright. As with most things, each option has its own set of advantages and disadvantages, so it is important to consider which may be the right options for you based on your lifestyle goals, long term goals and financial commitment you are prepared to make.

Second Home Ownership or Investment Property is the most typical way of owning a vacation home. When a person or couple take full ownership of a vacation property they are fully responsible for the upkeep. This can be the most burdensome and costly option for many reasons, however, managed and bought right it can also be highly rewarding.

Fractional Ownership is for those that don’t want the full responsibilities and risks of outright ownership but are still seeking a pride of ownership in a destination special to them and some financial return. Fractional owners essentially purchase a “share” of a property and have access to the property somewhere between 4 – 12 weeks annually along with the other 4 – 12 fractional owners.

Vacation Destination Clubs member’s pay a large upfront fee, in the $25,000 range, to gain access to a portfolio of luxury residences. You may have heard of Inspirato or Ritz-Carlton Destination Club, both are examples of vacation destination clubs. Typically, this option is best for those wanting to see the world in style, view travel as an investment in themselves & family and seek the benefit lifelong memories. Financial return is no consideration, nor even possible.

Vacation Equity Funds are a more recent concept and can be imagined as “investing where you play.” The idea is simple; to allow guest-investors to participate in the upside of the real estate market. It provides headache-free pride of ownership and usage in a portfolio of properties along with a financial investment in real estate, typically well into the $100k-$200k plus range. Vacation fund investors are typically looking for access to beautiful properties, investing time with people they love yet they get excited about the idea of making a wise financial investment that additionally comes with “lifestyle dividends,” – the usage benefits of the vacation fund’s properties. The fund’s properties are later sold at a pre-determined date, typically 10 years, in the future and the modest gains distributed to investors.

Related Content

How to Build Wealth With Vacation Rental Homes

How to Short the Dollar via Vacation Rentals

Vacation Rental Expenses Done Smart & Easy

Owning a Vacation Rental 101: Biggest Lessons Learned (Toilet Bowls?)

Michael Hamilton’s 5 Keys to Succeed as an Airbnb and Vacation Rental Owner (Confidential)