Summary of How to short the dollar?

- In this post & video, Why would Warren Buffett “load up” and buy a couple hundred thousand SFR if he could?

- Learn one of the most powerful (and least understood) financial principles “Shorting” and how it can be applied to all real estate investing

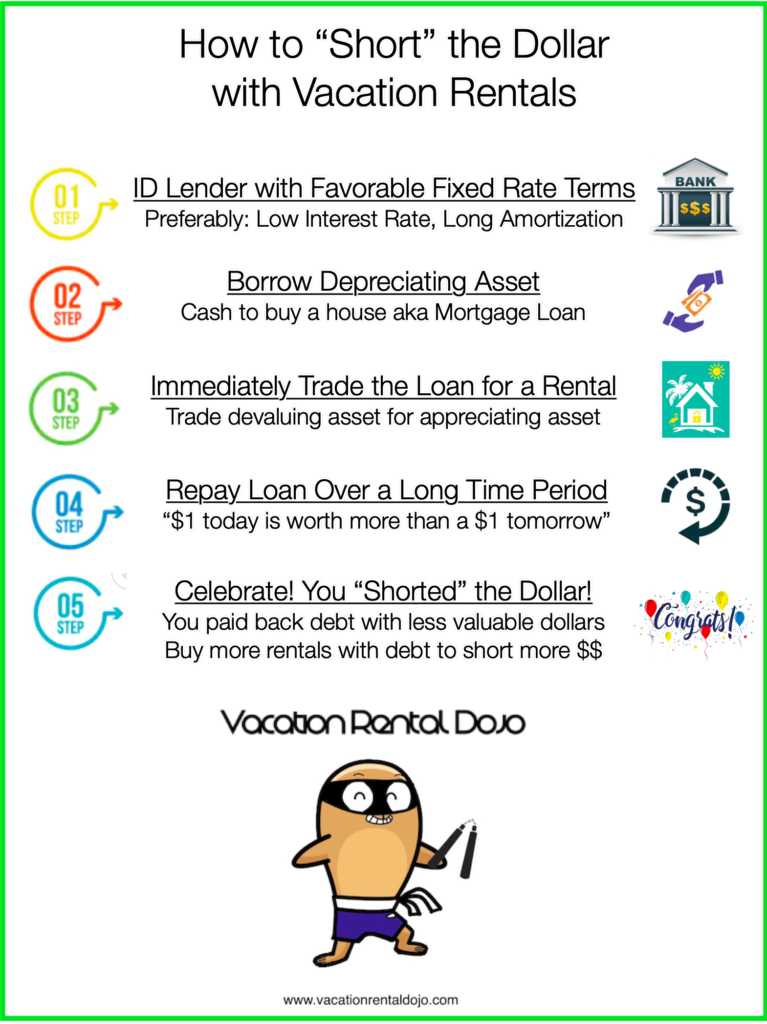

- We showcase our 5 Step “How to ‘Short’ the Dollar With Vacation Rentals” Process Explained!

- Better understand how using debt wisely can accelerate wealth building via a mortgage

Rad News & Opportunities!

- Updated & New Content: Vacation Rental Dojo, Mike & Maria’s Free online vacation rental learning center. PLUS Our Vacation Rental Business Plan in a Box!

- Vacation Rental Confidential, Our Book: VRC is a quick showcase of the Live Swell Story & Proven Biz Model Download Chapters 1 & 2 Free, Our Gift to You

- Exclusive NEW Release: Live Swell’s Sparkling Clean Training & Certification Program

What does “shorting the dollar” even mean?

Wise investors, in every asset class, understand time tested financial principles. As it relates to “how to short the dollar” the principle that must be understood is the Time Value of Money! Let’s start there, next we will cover the simple 5 steps to show you how to short the dollar.

“A dollar today is worth more than a dollar tomorrow”

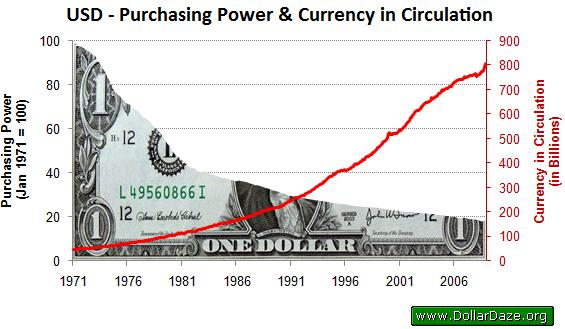

The time value of money means your dollar today is worth more than your dollar tomorrow. This is as a result of inflation. Inflation increases prices over time and decreases each dollar’s spending power. As each dollars’ spending power is reduced it will take more dollars to purchase the same thing.

“I remember when a candy bar cost a nickel?” says the grandparent!

Value is in scarcity. For example, if you are a donut eater, the 1st donut you eat is going to be more exciting (and valuable) than the 10th or 20th donut of the sitting. So it follows the more of something there is, the less valuable it becomes (when a new iphone is released the model(s) before it begin to decline in value). This principle holds true with currency too, when more and more money/currency is printed and put into circulation the less valuable each dollar becomes.

Back to “how to short the dollar,” but first what does it mean to “short” something?

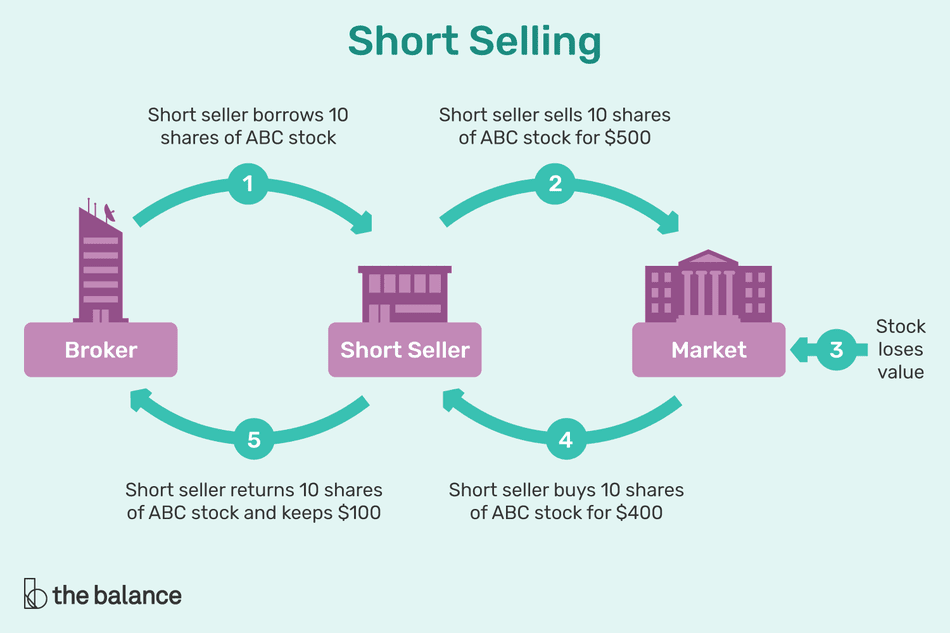

“Shorting” is an investing strategy to earn a profit by way of betting that an asset class (stock, bond, metals, currency) will go down in value. This may not be crystal clear yet, we will get there together…its tough for me sometimes too, thinking in reverse.

How to short the dollar? $USD, a currency, is an asset. Its also know as cash. Cash is an asset that goes down in value over time, due to inflation. The devaluation of the dollar is slow yet consistent, like a turtle.

A common way to short the US dollar is to trade it against other currencies or short stocks. If the trader bets correctly, the asset declines in value, he profit, if incorrect he loses.

Image courtesy of Live Swell & Vacation Rental Dojo

The Surprisingly Uncommon Method to Short The US Dollar

An uncommonly thought of method to short the $USD is with real estate debt, aka a mortgage. You must you leverage (aka detbt) to short the dollar, thats the way it works.

“Financing a property a mortgage, allows you to “short” the US Dollar.

When a person borrows and trades a depreciating asset, $USD in the form of a mortgage, for an appreciating asset, Real Estate, they are “locking in” a financing payment today, which will be the same, for the duration of the loan.

The same $2000 mortgage payment an investor makes on month #1 is the same they would make on month #360 of a 30 year fixed home loan, what is the difference? The $2000 payment today is worth more – has more buying power – than the same $2000 in 10, 20 or 30 years. Think about rents over a 30 year timeline. They typically go up right? What about the financing payment? It stays the same, if not changed! If you could go back 20 years would you buy as much real estate as you could?

The longer the “amortization period” or length of loan the better. When we lock in a “fixed” rate loan, the other guy, aka the bank is stuck with it for the term. Don’t feel bad for them!”

Excerpt From: Michael Hamilton. “Vacation Rental Confidential.” Apple Books.

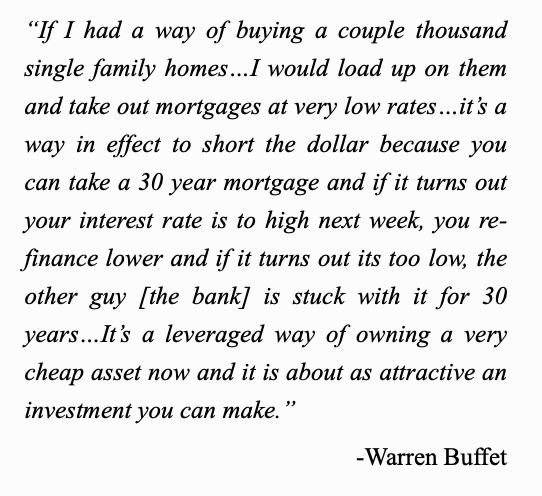

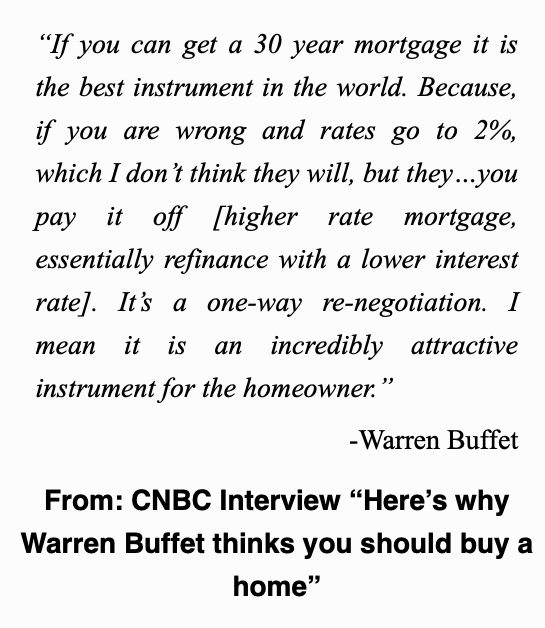

What does Warren Buffet think about shorting the dollar with a mortgage?

[embedyt] https://www.youtube.com/watch?v=KMvQPeBAesw[/embedyt]Shorting the Dollar, Get Cash Flow & Build Wealth via Vacation Rental Investments

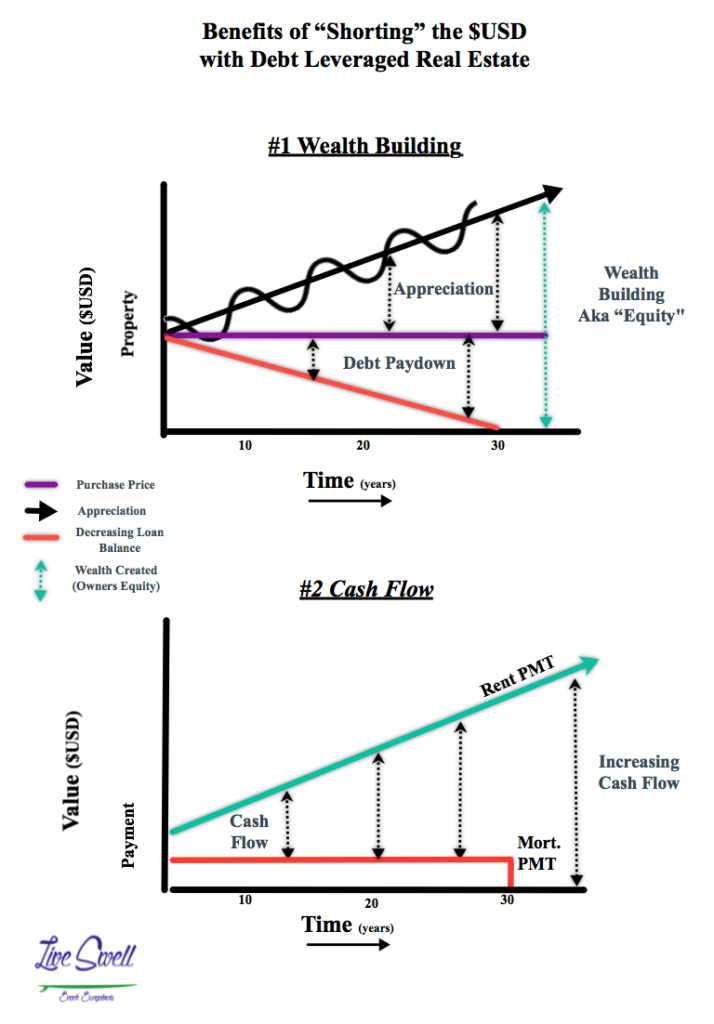

If your starting to see the value of shorting the dollar, well, it can get better a lot better! The reality is a well trained person can generate significant income streams and build millions in wealth with vacation rental investments. I have to stress the “well trained,” this is not an easy business, it is a simple business but it hinges on so many components, one of the first of which is a persons ability to identify and make wise investments and see value (buying right).

Below are two graphics from the book Vacation Rental Confidential. Money is earned in real estate in two simple ways, gains in property value and cash from from rental income.

The graphs below may or may not make sense on first view, that’s ok I will explain it clearly via video. What they are designed to showcase is how to build wealth and generate income when investing in a vacation rental.

How to short the dollar like Warren Buffet? Load Up on rentals!

Can I short the dollar with a traditional rental property?

The principles presented in this post apply to traditional long-term rental properties as well. Remember, in order to short the us dollar the investor must use leverage (aka debt or mortgage), preferably with a longer amortization term. Assuming the investor has purchased wisely and manages the business well they can build wealth and generate nice income streams with long term rentals.

Is it better to short the dollar with a long term rental or a short term rental?

It not that one or the other is a better vehicle to short the dollar with mortgage debt, there are some minor differences however. For example, vacation rental homes are typically located in area’s with median price point well above area with long term rentals with cash flow potential. The nice thing is, when a vacation rental home is financed, the loan amount can potentially be large. Thats a good thing, recall, that payment and interest rate is being locked in for 30 years!!! So you can short a lot of dollars with a single vacation rental purchase as opposed to many individual long term rentals.

Related Content

How to Build Wealth With Vacation Rental Homes